our

Approach

Our approach is deep-rooted in partnership, insight, and disciplined execution. We combine deep industry knowledge with a rigorous analytical framework to identify and nurture opportunities that drive growth, innovation, and long-term value.

Your Trusted Path to

Sustainable Growth

Partnership

Data Informed Decision

Sector Focused Industry

Value Creation

Long Term Perspective

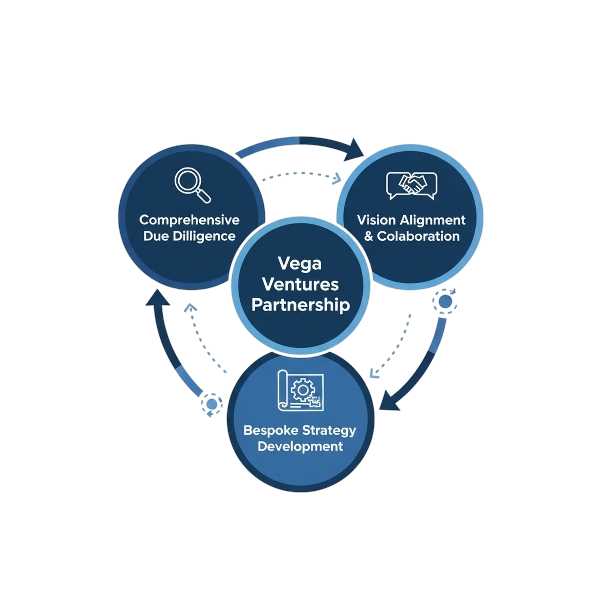

Partnerships

We believe in working closely with the entrepreneurs and management teams we invest in. By aligning our goals and collaborating at every stage, we foster relationships built on trust and shared vision. Our hands-on support goes beyond capital, offering strategic guidance, operational expertise, and access to a network of industry leaders.

Active Engagement

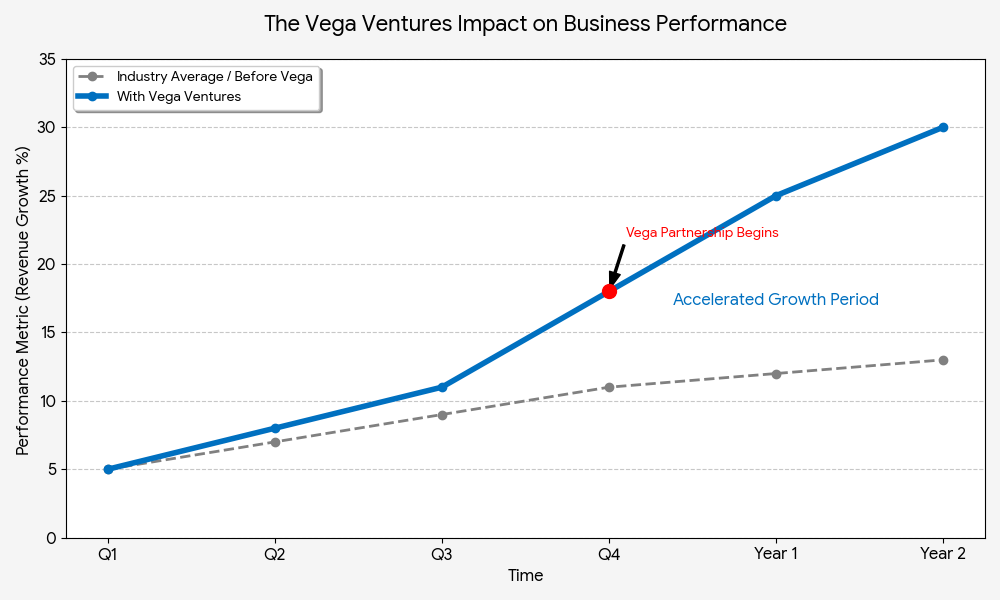

Strategic Implementation and Execution This is where the Vega Difference comes to life

We transition from planning to execution, embedding our operational expertise directly into the portfolio company's structure.

Data-Informed Decisions

Every investment we make is guided by comprehensive research, market analysis, and financial rigor. Our team leverages data-driven insights to assess risks, uncover growth potential, and make decisions that maximize returns. We are committed to transparency and disciplined evaluation, ensuring our investors and partners are informed and confident.

Value Creation

Our approach is not just about capital—it’s about creating enduring value. We actively work with portfolio companies to optimize operations, enhance market positioning, and drive sustainable growth. Our goal is to turn opportunities into thriving businesses that deliver exceptional returns to all stakeholders.

Sector-Focused Expertise

We focus on sectors where we have proven expertise and can add significant value. In venture capital, we invest in high-growth technology, AI, data analytics, and innovative startups. In private equity, we target established businesses with potential for operational improvement, scalable growth, and long-term sustainability.

Long-Term Perspective

We take a patient, long-term view on investments. By focusing on sustainable growth and strategic development, we help our portfolio companies navigate challenges, capitalize on opportunities, and achieve their full potential. Our commitment is to build lasting partnerships that create value today and for the future

Discovery & Alignment

Performance Optimization:

Data-Driven Disciplines

Our commitment to continuous improvement is rooted in quantifiable data. We establish a robust framework for measurement and accountability from day one.

- KPI Framework Establishment: We define and track a clear set of Key Performance Indicators (KPIs) relevant to each business model (e.g., EBITDA margin, Customer Acquisition Cost, Operational Uptime).

- Continuous Monitoring and Reporting: Our finance and data teams provide real-time, transparent reporting to both management and our investors. This ensures everyone is aligned on performance and allows for proactive course correction rather than reactive problem-solving.

- Risk Mitigation: By monitoring key operational and financial metrics, we are able to anticipate market shifts and operational bottlenecks, developing mitigation strategies before they impact performance.

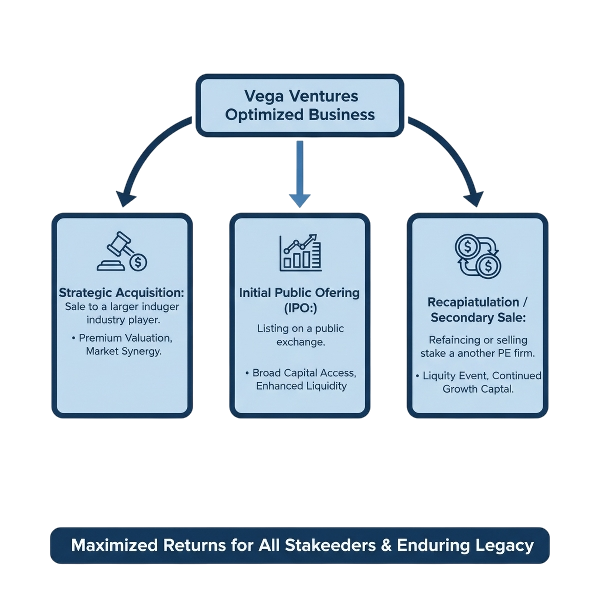

Value Realization: Maximizing Returns

The final stage of our approach is focused on optimizing the exit to ensure maximum value for all stakeholders—founders, employees, and investors.

Strategic Positioning: Long before an exit, we strategically position the business for its next phase of growth. This involves cleaning up the financial structure, building strong governance, and ensuring the business has scalable, repeatable processes.

Optimal Exit Planning: Whether it's a sale to a strategic buyer, a public offering (IPO), or a recapitalization, we guide the process meticulously. Our objective is to time the market effectively and select the buyer or transaction structure that maximizes valuation based on the significant growth achieved during our partnership.

Sustainable Legacy: We ensure the company is left with a strong foundation, a clear strategic roadmap, and a talented leadership team, creating a lasting legacy of success well beyond our investment horizon.