Building on a legacy of innovation and leadership, a unique approach that

combines unparalled strategy design, network, talent and precise execution.

Investing

Beyond

Investment & finance($)

Countries covered

+

Sectors covered

+

years of experience

+

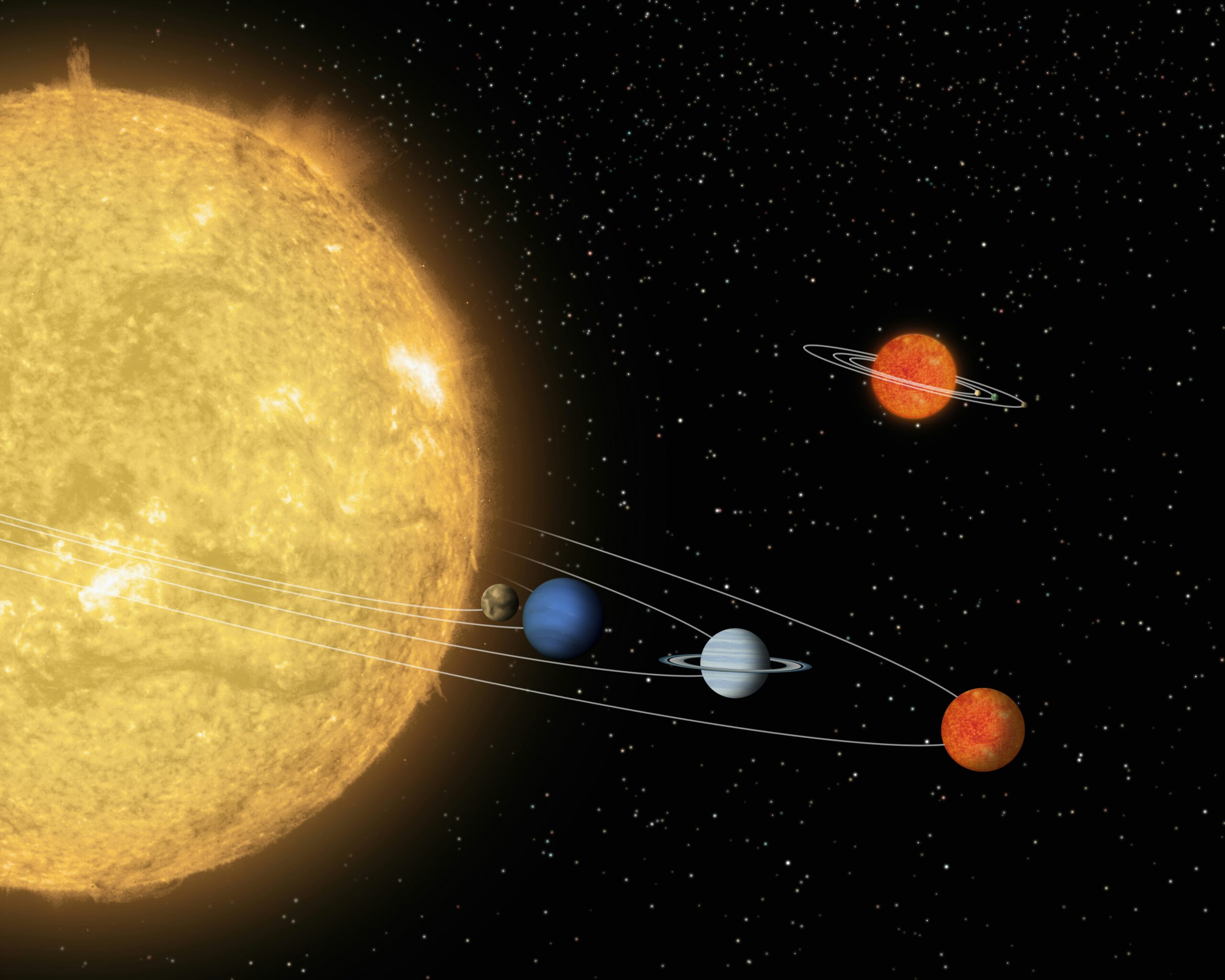

ouR north star:

partnering and leading Business focused on

change, growth and vision

Uniquely positioned to unlock the full potential of businesses across a diverse range of sectors. With a name inspired by the bright star Vega, reflecting the mission: to be a guiding force in the investment landscape, lighting the way to success for all businesses, partners and stakeholders. With the belief that true value is created not just by providing capital, but by actively engaging with the portfolio companies to build lasting, sustainable growth.

Private Equity

A hands-on partner driving growth—at times taking the helm to overhaul strategy and operations... expertise spans industries, strategy, transactions, efficiency, and delivering success.

Venture Capital

Partnering with visionary founders, we provide early-stage capital and strategic support to scale disruptive ideas into thriving businesses. By working alongside entrepreneurs and leveraging our network, we help transform promising enterprises into market leaders.

Sector

Focus

The sector focus is intentionally diverse, blending the high-growth potential of technology with the stable, asset-heavy nature of traditional industries. This dual-pronged strategy mitigates risk while maximizing opportunity.

Hospitality & Real Estate

identifying Hotels and real estate projects and properties with turnaround potential or expansion opportunities, optimizing operations, enhancing experiences, and unlocking hidden value.

Industrials

Focused on manufacturing—applying lean management, technology upgrades, and supply chain optimization to boost productivity, cut costs, and build competitive advantage.

Consumer & Distribution

Investing in and managing from restaurants to distribution companies—driving supply chain efficiency, data-driven marketing, and scalable operations to grow market share.

Essential Service

Including hospitals and educational facilities—focused on enhancing efficiency and service quality to build sustainable, impactful organizations.

Climate & Sustainablity

Focused on ESG-driven investments in clean energy, sustainable technology, and resource management platforms.

Technology & Software

Investing in next-gen software, AI, and data analytics—spanning SaaS, commerce, fintech, healthtech, insurtech, and cybersecurity. We back companies with strong IP and a clear path to commercialization.

Life Sciences & Healthcare

Focusing on ventures at the intersection of technology and health, including digital health platforms, biotech firms, and medical technology companies that can improve patient care and system efficiency.

Agreculture, AgriTech & Food Innovation

Developing and Investing in technologies that make the food system more efficient, sustainable, and resilient. This includes precision agriculture, vertical farming, alternative proteins, and supply chain technologies that reduce waste.

Our partners

Your Path to

Growth

Starts Here

The investment philosophy is derived from a long-term, patient approach to capital. Managing investments and companies that not only have the potential for significant financial returns but also possess a sustainable business model and a positive impact on their respective industries. The commitment is to transparency, integrity, and building lasting value for our investors.

We're built to innovate and grow. Building market-leading private businesses that are founded and thrive on the principles of driving innovation in diverse industries and regions.

Diversification | Active Management | Global Expansion | High Returns and Growth

01

A more perfect union of entrepreneur & capital

Patient capital

Fully aligned incentives

Lower risk/higher speed to heigh tensures the best risk-adjusted returns

02

The deepest pools of operational capability and talent

Elite forces DNA

Battle tested for the unique challenges of portco and private investment conditions

Build to the last

03