Private Equity

&

Venture capital

We combine an industrial and entrepreneurial mindset with a best-in-class thematic investing skill set to transform companies and build long-term value for our clients and stakeholders.

Private equity

venture capital

managed investment

credit offering

Private Equity:

Building Value Through Active Management

Our Private Equity (PE) strategy is centered on acquiring and actively managing established businesses that possess solid fundamentals but require strategic intervention to unlock their full value potential.

We act as hands-on managers, deploying our capital, expertise, and global network to transform businesses across a diverse range of asset-heavy and service-oriented sectors.

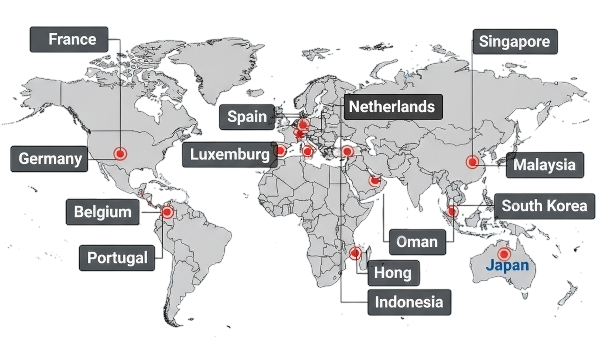

We source opportunities from small to large businesses across Europe and Asia, identifying targets for either strategic consolidation within fragmented industries or for deep operational restructuring and strategic redirection.

Europe: Consolidation, Operational Efficiency" and "Asia

Market Expansion, Rapid Growth Sectors

Post acquisitions, our involvement is highly active and transformative. We integrate our seasoned Operating Partners into key leadership roles, directly managing operations to implement best practices in supply chain, finance, and technology.

For fragmented markets, we execute a “buy-and-build” strategy, consolidating smaller competitors, centralizing functions, and standardizing operations to create scalable, unified platforms. Beyond operational control, we focus heavily on brand building and repositioning, professionalizing marketing and sales to establish a distinctive market identity for assets ranging from hospitality concepts and manufacturing facilities to essential services like healthcare and education.

This comprehensive approach ensures that every aspect of the business is optimized for growth and long-term sustainability, creating strong, resilient enterprises.

Venture Capital Fueling Disruptive Growth

A Partnership in Practice

Our Venture Capital (VC) strategy is dedicated to identifying and partnering with visionary founders who are building disruptive startups at the cutting edge of technology and industry transformation. We provide the crucial early-stage capital, strategic acceleration, and network connectivity necessary to rapidly scale innovative ideas into dominant market forces. Our approach is geographically nimble, with a focus on sourcing high-potential companies across global innovation hubs.

Venture Capital Value-Add Spectrum

Our ultimate goal is to rigorously prepare our VC companies for their next funding rounds or eventual strategic acquisition. We focus on building defensible business models, robust technology platforms, and compelling financial narratives that position them as premium acquisition targets or candidates for highly successful public listings.

Managed Investment

Global Structuring for Strategic Partnerships

At Vega Ventures, we recognize that sophisticated investors require flexible, globally compliant, and tax-efficient structures to deploy capital effectively. Our Managed / Associated Partners specialize in creating tailored investment vehicles that align precisely with the strategic goals, risk profiles, and geographic requirements of institutions, family offices, high-net-worth individuals, and private investors. We don’t just source assets; we provide the complete architecture for seamless global investment.

Selective Syndications

This allows our investors to gain direct, concentrated exposure to the high-conviction assets sourced and actively managed by the Vega team

Professional Oversight

Managed by a designated committee, board, or operator to ensure compliance and accountability.

Diversification

Structures allow access to a mix of sectors and projects, reducing reliance on any single opportunity.

Flexible Formats

Can be tailored to suit growth, income generation, or strategic partnerships.

Global Structuring and Compliance

Regulated Funds (Open & Close-Ended)

Manage formation and ongoing compliance of funds tailored for institutional capital, providing liquidity options (open-ended) or fixed-term commitment (close-ended) for large, long-term asset portfolios.

Trusts and Holding Structures

We utilize specialized trust and holding companies to optimize inter-generational wealth transfer, secure asset ownership, and achieve tax efficiency for private wealth and family offices.

Limited Liability Companies (LLCs) and SPVs

For targeted, project-specific investments (like a single real estate development or infrastructure project), we establish Special Purpose Vehicles (SPVs) or LLCs. These structures ring-fence risk and allow for direct, focused co-investment opportunities.

Partnership and Portfolio Construction

Bespoke Portfolio Building

We work with partners to define specific mandates (e.g., European distressed real estate, Asian renewable energy ventures). We then source, diligence, and manage the acquisition of assets that fit these parameters, building a robust, diversified portfolio tailored to the partner's unique strategy.

Co-Investment Opportunities

Partners have the opportunity to co-invest alongside Vega Ventures in our most promising deals—both in our Private Equity buyouts and our late-stage Venture Capital rounds. This provides direct exposure to assets undergoing active management and strategic value creation by our operating teams.

Full Asset Lifecycle Management

From initial deal sourcing and due diligence through acquisition, active management (operational oversight, risk monitoring, value enhancement), and optimized exit, we handle the entire asset lifecycle. This ensures seamless execution and maximized returns within the designated legal and tax framework.

Credit Offerings Flexible Capital & Investment Solutions

While our core focus is on equity and active management, Vega Ventures offers a specialized suite of Credit Offerings designed to provide flexible, non-dilutive, and strategically tailored capital solutions to our portfolio companies and external partners

Growth and Bridge Financing

Working Capital and Operational Support

Convertible Notes

Primarily used in our Venture Capital portfolio, these offer fast, flexible financing that converts into equity at a later date, deferring the valuation discussion and allowing the company to focus on achieving key milestones.

Credit Notes (Term Loans)

Providing structured debt capital with fixed repayment schedules, these are suitable for established Private Equity portfolio companies needing funds for specific capital expenditures (CapEx), strategic acquisitions, or growth initiatives where equity dilution is undesirable.

Trade Financings

Bespoke solutions, such as letters of credit or guarantees, to facilitate cross-border transactions and manage supply chain liquidity, particularly beneficial for our manufacturing and distribution businesses in Europe and Asia. This enables our partners to secure inventory and meet large orders efficiently.

Invoice Factoring and Receivables Financing

We provide capital against outstanding invoices, helping businesses manage cash flow volatility and accelerate working capital, ensuring they can fund immediate operational needs and sustain rapid growth.