NEWS & INSIGHTS

Catch up on our latest news and updates, including timely and thought-provoking perspectives on the industry, markets and our business from Vega experts.

Why Active Private Equity Outperforms Passive Waiting

In the world of investment, the allure of a "set it and forget it" passive strategy can be tempting. The idea of simply buying an asset and waiting for market forces to deliver returns, a 'miracle' of sorts, holds a certain appeal. However, in the dynamic and often complex realm of private markets, this approach is not just suboptimal—it's often a recipe for missed opportunities. At Vega Ventures, our core belief is that private equity, when combined with hands-on active management and a deliberate build-and-exit strategy, consistently outperforms passive investment, driving superior, risk-adjusted returns.

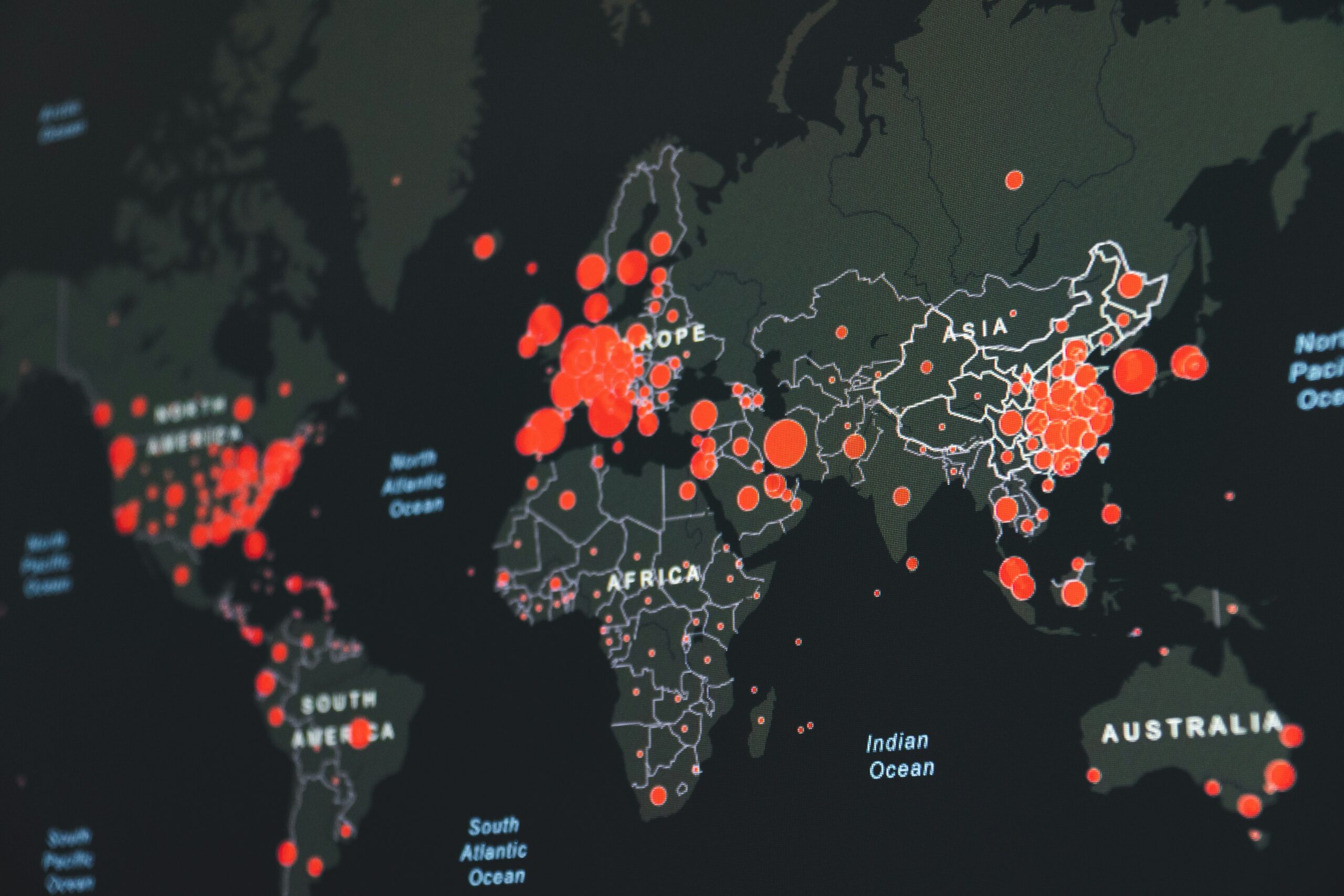

Navigating the Next Chapter: Why Europe’s Investment Outlook is Strong for the Next Five Years

While some headlines focus on short-term turbulence, smart capital is looking past the immediate challenges and recognizing the profound, structural resilience and growth potential embedded within the European economy. At Vega Ventures, we see a compelling and positive investment outlook for Europe over the next five years, driven by strategic transitions in technology, sustainability, and industrial consolidation. Europe is not just recovering; it's reinventing.