Beyond the Blind Pool: Why Global Investment Structures are the Real Key to Alpha

Beyond the Blind Pool: Why Global Investment Structures are the Real Key to Alpha

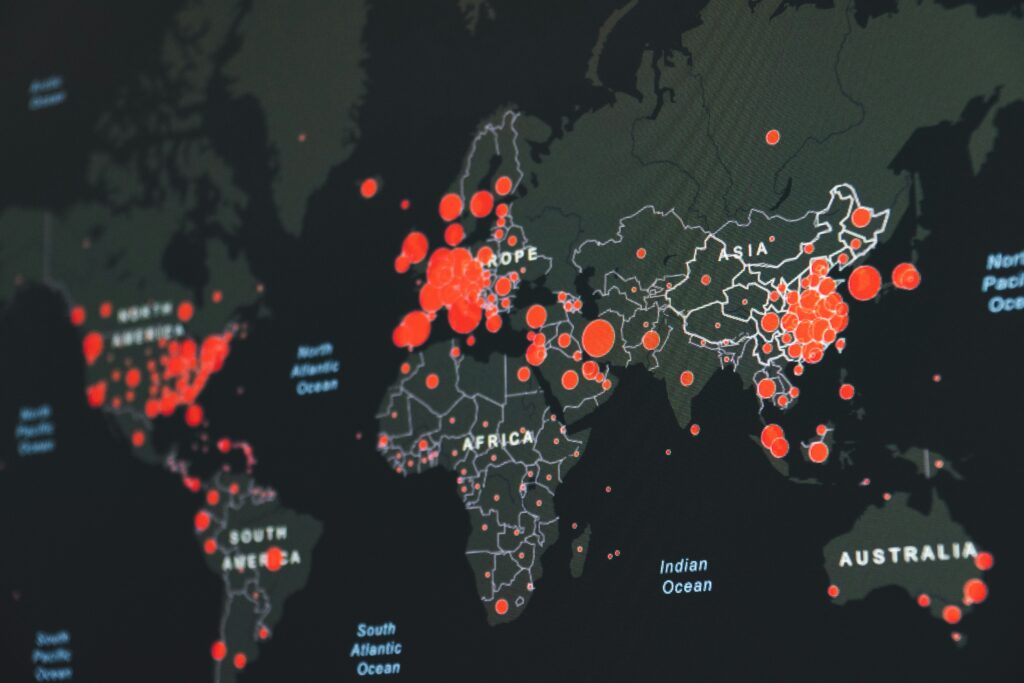

In the world of international finance, the structure of an investment is often as critical as the asset itself. For private equity and large-scale cross-border investments, a boilerplate approach simply won’t work. The savvy use of flexible structuresand strategic syndication across global jurisdictions is what truly unlocks superior returns, managing risk, and navigating the complex tapestry of international tax and regulation.

Structural Resilience and Strategic Consolidation

Beyond the headline transitions, Europe offers a powerful combination of stability and efficiency essential for long-term private equity growth:

- Political Stability and Regulatory Clarity:While consensus is slow, the EU offers one of the world’s most stable regulatory environments. This predictability is highly valued by long-term investors, especially in capital-intensive sectors like infrastructure and manufacturing.

- Industrial Fragmentation and Consolidation:Many of Europe’s traditional sectors—from specialized manufacturing and logistics to essential services—remain highly fragmented. This structure is ideal for Vega Ventures’ “buy-and-build” consolidation strategy. By acquiring numerous small, successful local businesses and unifying them onto a single, modern operational platform, we achieve significant economies of scale, professionalize management, and create market leaders ready for a premium exit.

- The Global Gateway:Europe remains the central hub connecting North America, Asia, and Africa. Its robust logistics infrastructure, port network, and advanced manufacturing capabilities position it as a key node in the evolving global supply chain, making European distribution and manufacturing companies excellent targets for global-minded investors.

Why Active Management is Key

Passive investing in Europe often captures only average market returns. The real alpha is generated by actively engaging with companies to solve operational challenges, drive digitalization, and execute strategic consolidation. Our hands-on approach ensures we are not waiting for a miracle; we are engineering the value creation necessary to capitalize on Europe’s green and digital destiny. We believe the next five years will reward those who are positioned to actively partner with Europe’s innovators and restructurers.

Key Legal Structures for Global Investment Efficiency

The choice of legal entity dictates everything from liability protection to tax treatment. Global investors strategically employ different vehicle types to achieve optimal operational and legal outcomes in a cross-border environment.

- Special Purpose Vehicles (SPVs)

The SPV, or Special Purpose Entity (SPE), is the backbone of modern structured finance and private equity. An SPV is a separate legal entity (often an LLC, Limited Partnership (LP), or corporation) created for a very narrow, specific purpose—usually to hold a single asset or execute one specific transaction.

Benefit | How it Works Globally |

Liability Isolation | The SPV creates a “ringfence” around the asset. If a project fails or a lawsuit arises in one country, the creditors can only target the assets within that specific SPV, protecting the fund’s broader portfolio and the parent company (bankruptcy remoteness). |

Regulatory Compliance | In some jurisdictions, foreign entities are prohibited or restricted from directly owning certain assets (e.g., real estate). An SPV, set up locally, provides the necessary legal ownership vehicle. |

Efficient Asset Transfer | Instead of selling a physical asset (like a piece of property) which incurs local transfer taxes and registration, the investor can simply sell the shares of the SPV that owns the asset, streamlining the exit process. |

Export to Sheets

- Holding Companies (HoldCos)

HoldCos are typically established in jurisdictions with favorable tax treaties to serve as intermediate owners of the operating assets (or SPVs).

- Tax Efficiency on Dividends: A major benefit is the ability to receive tax-free or low-tax intercorporate dividends from operating subsidiaries in other countries, leveraging favorable double-taxation treaties between jurisdictions like the Netherlands, Luxembourg, or Ireland.

- Centralized Treasury: They allow for the efficient accumulation and reinvestment of retained earnings without immediate taxation at the parent level, providing flexibility in allocating capital across the portfolio.

- Asset Protection: By separating high-risk operations into distinct operating companies (OpCos) beneath the HoldCo, the HoldCo’s valuable assets (such as intellectual property, trademarks, or excess cash reserves) are shielded from the OpCo’s potential liabilities.

Key Legal Structures for Global Investment Efficiency

The choice of legal entity dictates everything from liability protection to tax treatment. Global investors strategically employ different vehicle types to achieve optimal operational and legal outcomes in a cross-border environment.

- Special Purpose Vehicles (SPVs)

The SPV, or Special Purpose Entity (SPE), is the backbone of modern structured finance and private equity. An SPV is a separate legal entity (often an LLC, Limited Partnership (LP), or corporation) created for a very narrow, specific purpose—usually to hold a single asset or execute one specific transaction.

Benefit | How it Works Globally |

Liability Isolation | The SPV creates a “ringfence” around the asset. If a project fails or a lawsuit arises in one country, the creditors can only target the assets within that specific SPV, protecting the fund’s broader portfolio and the parent company (bankruptcy remoteness). |

Regulatory Compliance | In some jurisdictions, foreign entities are prohibited or restricted from directly owning certain assets (e.g., real estate). An SPV, set up locally, provides the necessary legal ownership vehicle. |

Efficient Asset Transfer | Instead of selling a physical asset (like a piece of property) which incurs local transfer taxes and registration, the investor can simply sell the shares of the SPV that owns the asset, streamlining the exit process. |

Export to Sheets

- Holding Companies (HoldCos)

HoldCos are typically established in jurisdictions with favorable tax treaties to serve as intermediate owners of the operating assets (or SPVs).

- Tax Efficiency on Dividends: A major benefit is the ability to receive tax-free or low-tax intercorporate dividends from operating subsidiaries in other countries, leveraging favorable double-taxation treaties between jurisdictions like the Netherlands, Luxembourg, or Ireland.

- Centralized Treasury: They allow for the efficient accumulation and reinvestment of retained earnings without immediate taxation at the parent level, providing flexibility in allocating capital across the portfolio.

- Asset Protection: By separating high-risk operations into distinct operating companies (OpCos) beneath the HoldCo, the HoldCo’s valuable assets (such as intellectual property, trademarks, or excess cash reserves) are shielded from the OpCo’s potential liabilities.