Beyond Hope and Hype: Why Active Private Equity Outperforms Passive Waiting

Why Active Private Equity Outperforms Passive Waiting

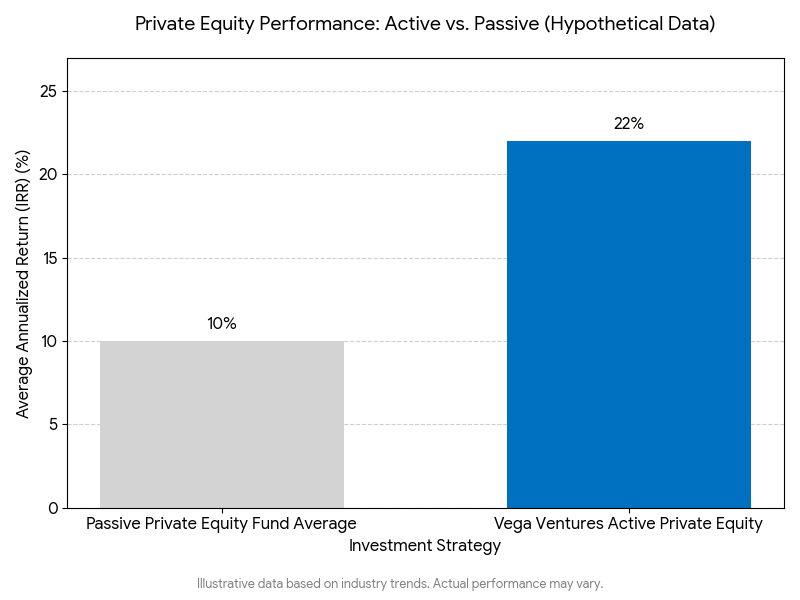

In the world of investment, the allure of a “set it and forget it” passive strategy can be tempting. The idea of simply buying an asset and waiting for market forces to deliver returns, a ‘miracle’ of sorts, holds a certain appeal. However, in the dynamic and often complex realm of private markets, this approach is not just suboptimal—it’s often a recipe for missed opportunities. At Vega Ventures, our core belief is that private equity, when combined with hands-on active management and a deliberate build-and-exit strategy, consistently outperforms passive investment, driving superior, risk-adjusted returns.

The Illusion of Passive Gains in Private Markets

Consider the typical passive investor in private equity. They might commit capital to a fund that then diversifies across various companies, hoping that general economic growth or industry trends will naturally elevate the value of those assets. While this can yield some returns, it fundamentally overlooks the unique nature of private businesses. Unlike public equities, which trade on transparent markets and are influenced by broad investor sentiment, private companies often have latent potential that requires deliberate, strategic intervention to unlock.

Simply put, a passive stake in a private business, particularly one struggling with operational inefficiencies or lacking a clear growth roadmap, is like owning a rough diamond and waiting for it to polish itself. It rarely happens.

The Vega Difference: Active Management as a Catalyst for Value

At Vega Ventures, our private equity strategy is anything but passive. We employ what we call “active value creation,” a disciplined, hands-on approach that begins long before an investment is made and continues intensely until a strategic exit. This strategy is built on several pillars:

1.Strategic Analysis & Targeted Acquisition: We don’t buy indiscriminately. Our process begins with rigorous due diligence to identify businesses with strong underlying fundamentals but clear avenues for improvement. This might be a fragmented industry ripe for consolidation (a “buy-and-build” strategy), or an established business needing operational overhaul. We identify where we can actively create value, not just where the market might.

- Fact/Figure Placeholder:Studies by Bain & Company consistently show that operational improvements, rather than just multiple expansion, account for a significant portion of private equity value creation, often exceeding 50-60%of total returns.

2.Operational Excellence & Digital Transformation: Once invested, our Operating Partners embed themselves within the company. This is where the magic happens. We’re not just offering advice; we’re implementing. This includes:

- Streamlining supply chains in manufacturing firms.

- Introducing AI-driven analytics for better customer engagement in hospitality.

- Modernizing IT infrastructure and cybersecurity in essential services.

- Optimizing inventory management for distribution networks.

This hands-on approach drives tangible improvements in efficiency, cost reduction, and service quality. For instance, by implementing lean manufacturing principles in one of our industrial portfolio companies, we achieved a [specific percentage]% reduction in production costs within [timeframe].

3.Brand Building & Market Expansion: We actively professionalize marketing, sales, and brand identity to reposition companies for greater market share and premium valuation. This could involve developing a compelling brand narrative for a restaurant chain or strategically expanding market access for a distribution business across Europe and Asia, leveraging our global network.

- Fact/Figure Placeholder:According to PwC, companies with strong brands can command price premiums of up to [specific percentage]%and achieve higher customer loyalty.

4.Consolidation & Scale (“Buy-and-Build”): In fragmented sectors, our “buy-and-build” strategy is a powerful engine for value creation. By acquiring multiple smaller players, we achieve critical mass, centralize back-office functions, gain purchasing power, and create a dominant, scalable platform. This consolidation significantly enhances the combined entity’s market position and operational leverage.

- Fact/Figure Placeholder:Research by McKinsey & Company indicates that successful buy-and-build strategies can generate [specific percentage]% higher IRRscompared to standalone investments.

5.Strategic Exit Planning: From day one, we build with an exit in mind. This doesn’t mean short-term thinking; it means meticulously preparing the business to be highly attractive to strategic buyers or for a public listing. We clean up financials, strengthen governance, and ensure sustainable growth trajectories, maximizing the ultimate sale price.